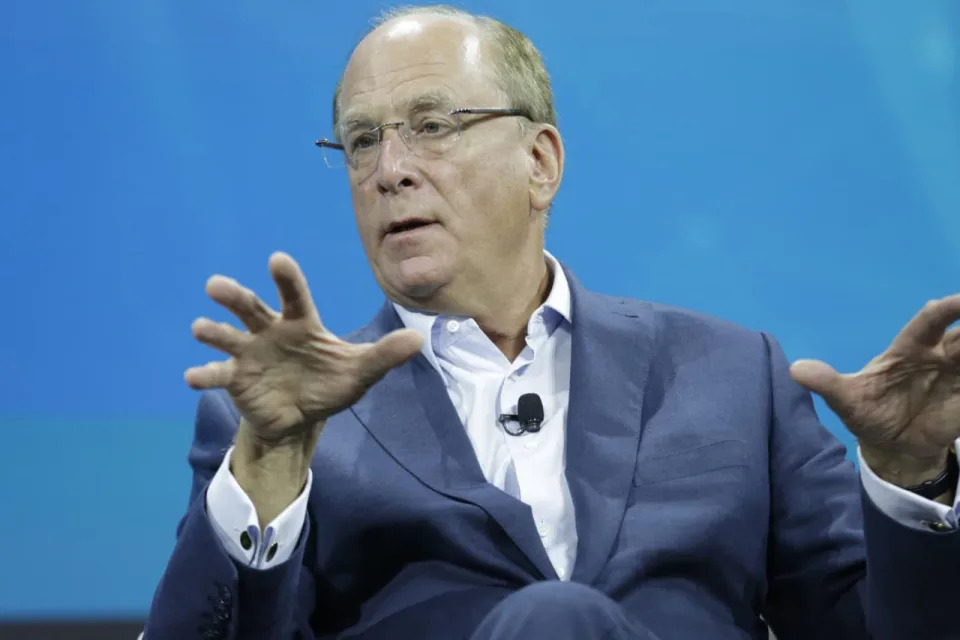

BlackRock’s Larry Fink says bitcoin could reach $700,000 if this happens

That’s Larry Fink, chief executive at BlackRock Inc., the world’s largest asset manager, who says that bitcoin could reach $700,000 if more funds consider adding a 2% to 5% allocation into the crypto.

Last year, BlackRock BLK launched its iShares Bitcoin Trust IBIT and iShares Ethereum Trust ETHA — exchange-traded funds investing directly into bitcoin and ether, respectively — after Fink’s stance on crypto took a sharp turn.

Read: BlackRock’s Larry Fink once said his clients had zero interest in crypto. Here’s how things have changed since 2018.

Fink, who used to be skeptical of digital assets and said in 2018 that BlackRock’s clients had zero interest in crypto, said on Wednesday that he is a “big believer” in the utilization of bitcoin BTCUSD as an instrument.

“If you’re afraid of the debasement of your currency, or you’re frightened of the economic or political stability of your country, you can have an internationally based instrument called bitcoin that will overcome those local fears,” Fink said at a panel at the World Economic Forum in Davos on Wednesday.

“I was with a sovereign-wealth fund during this week, and there was a conversation, should we have a 2% allocation? Should we have a 5% allocation? If everybody adopted that conversation, it would be $500,000, $600,000, $700,000 for bitcoin,” Fink said.

The largest cryptocurrency by market capitalization traded at around $103,998 on Wednesday, pulling back slightly from its record high of $109,225 on Monday, according to Dow Jones Market Data.

“I am not promoting that [bitcoin] by the way,” Fink added on Wednesday. Cryptocurrencies are known to be highly volatile. Even during a bull run, it has not been rare for bitcoin to see a 20% to 30% pullback.