Agilysys (NASDAQ:AGYS) Misses Q4 Revenue Estimates, Stock Drops 13.4%

Hospitality industry software provider Agilysys (NASDAQ:AGYS) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 14.9% year on year to $69.56 million. The company’s full-year revenue guidance of $273 million at the midpoint came in 3.2% below analysts’ estimates. Its non-GAAP profit of $0.38 per share was 10.9% above analysts’ consensus estimates.

Is now the time to buy Agilysys? Find out in our full research report .

Agilysys (AGYS) Q4 CY2024 Highlights:

Company Overview

Originally a subsidiary of Pioneer-Standard Electronics that distributed electronic components, Agilysys (NASDAQ:AGYS) offers a software-as-service platform that helps hotels, resorts, restaurants, and other hospitality businesses manage their operations and workflows.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Sales Growth

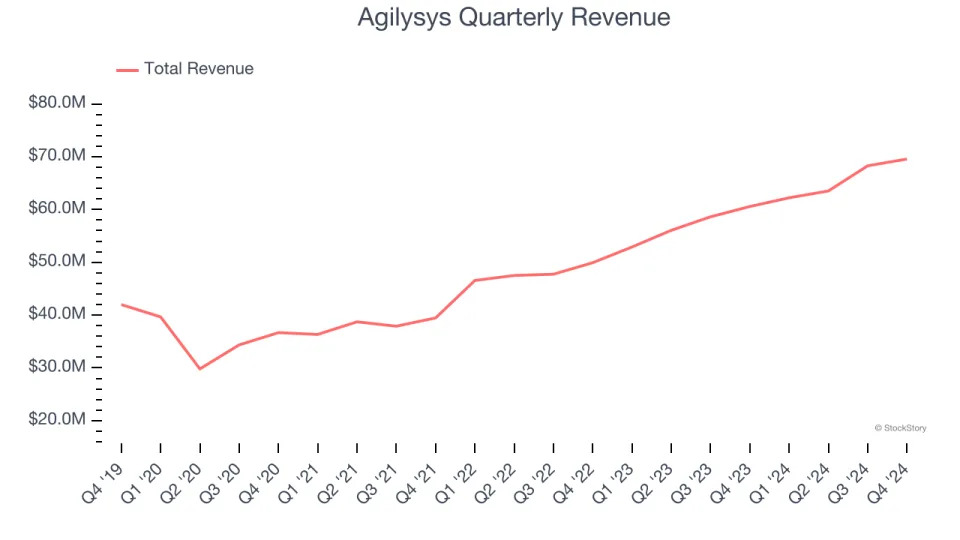

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Agilysys’s sales grew at a decent 20% compounded annual growth rate over the last three years. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Agilysys’s revenue grew by 14.9% year on year to $69.56 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 23.4% over the next 12 months, an acceleration versus the last three years. This projection is admirable and implies its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. .

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Agilysys is very efficient at acquiring new customers, and its CAC payback period checked in at 22.4 months this quarter. The company’s rapid sales cycles indicate it has a highly differentiated product offering and a strong brand reputation. These dynamics give Agilysys more resources to pursue new product initiatives while maintaining optionality.

Key Takeaways from Agilysys’s Q4 Results

Revenue in the quarter missed and its full-year revenue guidance missed significantly after being dropped from previous levels. The company said "revenue levels, especially one-time product revenue, continue to be impacted by recent sales challenges with point-of-sale products, mainly in the managed food services vertical, caused by our final modernization transition phase." Overall, this was a weaker quarter. The stock traded down 13.4% to $109 immediately following the results.

Agilysys’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free .