The U.S. economy is in a ‘sweet spot.’ But markets may be getting one thing wrong, says Goldman Sachs.

The U.S. economy is in a “sweet spot” and the market is possibly too pessimistic on the pace of Federal Reserve interest rate cuts.

That’s according to Jan Hatzius, chief economist at Goldman Sachs, who in a new note published Monday, said the key question for monetary policy is how aggressively the Trump administration implements its import tariff agenda.

“On Inauguration Day 2025, the U.S. economy is in the sweet spot of healthy growth and gradual disinflation,” said Hatzius.

Goldman estimates that real GDP grew 2.6% in the fourth quarter of last year and expects a similar pace in 2025, helped by signs the labor market is in good health and not slowing as much as some had feared.

“The labor market signal has caught up with the GDP signal as payrolls grew 256,000 in December and the 3- and 6-month trend rates are above our 150,000 estimate of the breakeven rate that keeps the unemployment rate stable,” said Hatzius.

It’s what Hatzius describes as a low-hiring/low-firing jobs market, with wage inflation in the 3.5 to 4% range that — given the 1.5-2% productivity trend over the past five years — is consistent with 2% price inflation.

“[T]here’s a Goldilocks flavor to it, as the strength does not point to a renewed risk of labor market overheating,” said Hatzius.

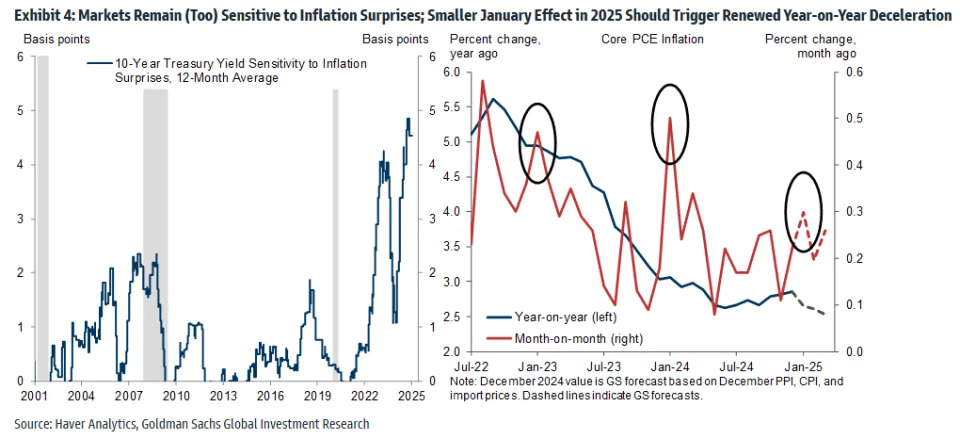

However, he noted that although the December consumer price inflation report came in below forecasts, implying a personal consumption expenditure inflation measure of just 0.16%, the disinflationary trend is obscured by month-to-month volatility. And this has rattled markets of late.

“[T]he underlying trend has changed much less than one might think from the volatility in the market narrative, as well as the outsized bond market impact of month-to-month inflation surprises,” said Hatzius.

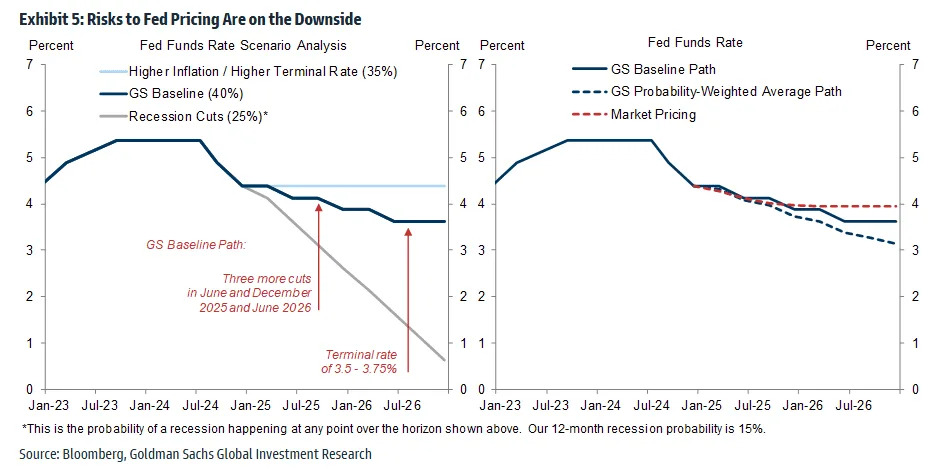

Still, Goldman reckons inflation will be sufficiently benign that the Federal Reserve can continue to reduce borrowing costs. There will be no interest rate cut in January, said Hatzius, but also no meaningful risk of a rate hike anytime soon, as some investors were fearing just a week or so ago.

“Beyond that, the picture is murky, as cuts look justifiable given the ongoing disinflation but not essential in light of the strength in the real economy. Nevertheless, we have a strong view that market pricing is too hawkish on a probability-weighted basis,” said Hatzius.

Goldman’s forecast is for two 25 basis point rate cuts by the Fed this year, in June and December, with another such reduction in 2026 that means the central bank will stop its easing cycle at a rate of 3.5-3.75%.

“But the risks to this forecast are tilted to the downside on net, both because the Federal Open Market Committee might decide to cut before June even if the economy does fine and because the FOMC would probably cut a lot more aggressively in the—unlikely but far from remote—event of a sharper deterioration in the economic data or in risk sentiment,” said Hatzius.

The main factor that could disturb these growth and policy projections is the Trump tariffs. Goldman thinks that the new administration will apply tariff hikes on China averaging 20% to be applied over the next couple of months. There may be “aggressive” tariffs on European autos and Mexican electric vehicles. Across the board tariffs have become less likely, but a universal tariff on “critical goods” more so, Hatzius reckons.

Tariff news is likely to continue creating volatility in financial market, he warned, even though their impact on Fed policy may be more double-edged than investors think.

“In 2018-2019, after all, the intensifying trade war set the stage for three 25bp rate cuts. While many commentators point out that this occurred in an environment of below-target inflation then (vs. above-target inflation now), it is also true that the funds rate is above neutral now (vs. below neutral then) and that labor market utilization is lower to boot,” Hatzius concluded.