Stock-market rally depends on answer to this ‘real question’ about bond yields

Stock-market bulls pulled themselves together this past week, but worries over a peculiarly strong rise in long-term Treasury yields likely haven’t been dispelled, particularly given uncertainty around what Donald Trump is likely to deliver when he returns to the White House on Monday.

It isn’t just that yields are doing something they don’t normally do when the Federal Reserve is cutting its policy interest rate, but that the rise in yields is coming when stocks are expensive — the S&P 500’s forward 12-month price-to-earnings ratio was at 21.6 as of Friday, according to FactSet, above the 5-year average of 19.7 and the 10-year average of 18.2.

Rising yields can make already expensive stocks look less favorable relative to bonds sporting increasingly attractive yields. As analysts at TS Lombard put it in a Friday note: “Rising rates would make it difficult for already high valuations to go even higher.”

Need to Know: The bull market faces a Trump ‘reality check’ next week, says this strategist. Here’s the trade to make.

Look at the past week to see how Treasurys appear to be calling the tune. After hitting a 14-month high above 4.8% on Tuesday, the yield on the 10-year Treasury note BX:TMUBMUSD10Y dropped sharply after a cooler-than-expected December core consumer-price index reading on Wednesday and ended Friday at 4.61%.

Stocks found their footing, with the S&P 500 index SPX and Dow Jones Industrial Average DJIA posting their largest weekly gains since the week ending Nov. 8, which was the week of the presidential election. That comes after the S&P 500 briefly erased all of the 6.6% rise seen between Donald Trump’s Nov. 5 presidential election victory and its intraday record set on Dec. 6.

See: A final look at how the U.S. sto c k market performed under Joe Biden

Now, much depends on whether the past week marked a peak in yields or was merely a snapback after getting technically overstretched, said Jeff deGraaf, chairman and head of technical research at Renaissance Macro Research.

“The real question for the remainder of the quarter, and probably much of 2025 is whether or not the recent overbought proves an interim peak in yields that provides temporary relief for stocks, or if it proves more durable and lasting with yields tumbling back toward 4.0%?” he said in a note.

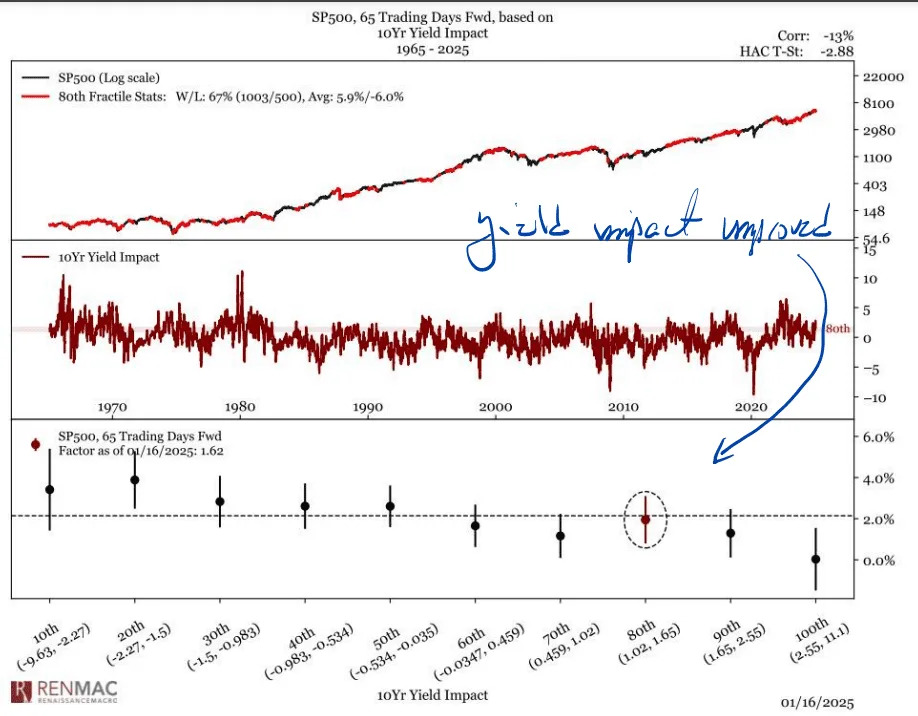

DeGraaf said the drop in yields put RenMac’s measure of the stock market’s sensitivity to yields between the 70th and 80th percentile, a zone that’s been consistent with average S&P 500 returns over the following 65 trading days, or roughly 13 calendar weeks (see chart below).

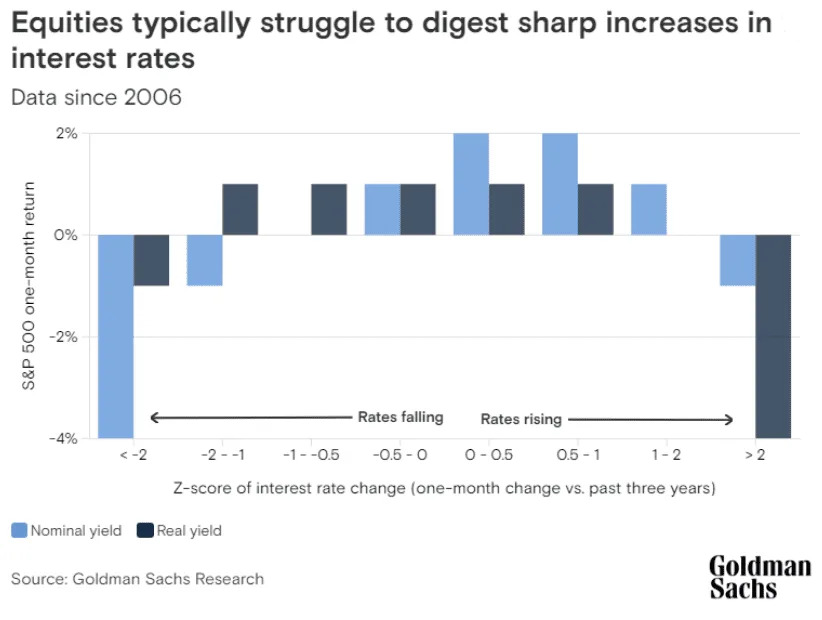

Investors have spent a lot of time fretting about at what level the 10-year yield might start to put a severe crimp in demand for equities. Analysts have noted it isn’t just the absolute level of the yield, but how fast it moves that can rattle markets.

History shows stocks can usually handle a gradual rise in yields just fine, according to analysts at Goldman Sachs. But the S&P 500 has tended to struggle if the 10-year yield moves more than two standard deviations, which would currently be equal to around 60 basis points, or 0.6 percentage points, in a month, they found (see chart below).

Through Jan. 14, when yields were at their recent peak, the 10-year yield had risen by around 40 basis points over the previous 30 days, and by around 50 basis points from their early December low, the Goldman analysts noted.

So what’s driving the move in yields. Relief this week came from the December CPI reading, as well as remarks by Federal Reserve Gov. Christopher Waller, who said policymakers could still deliver several rate cuts in 2025 — at odds with market expectations.

But yields have risen significantly despite the Fed’s 2024 cuts. Concerns about the burgeoning U.S. fiscal deficit and fears that President-elect Donald Trump will do little to rein it in and may expand it, despite pledges to cut spending, have been cited as a potential driver, along with the potential for aggressive import tariffs to boost inflation.

Key Words: Paul Krugman thinks bond yields may be rising due to an ‘insanity premium’

The rise in yields may reflect ideas the Fed made a mistake in cutting interest rates by 100 basis points in 2024, analysts said. It may also reflect a strong economy, which could ultimately bode well for stocks despite interim jitters over rising bond yields.

Investors, meanwhile, are bracing for volatility across financial markets after Trump takes the oath of office on Monday. News reports say Trump is set to issue as many as 100 executive orders.

Investors and traders will likely spend the holiday-shortened week, with U.S. markets closed Monday for the Martin Luther King Jr. holiday, on headline watch, awaiting details of Trump’s approach to reshaping global trade and immigration policy, said Ian Lyngen and Vail Hartman, rates strategists at BMO Capital Markets, in a note.

As for Treasury yields, this week’s pullback may offer some breathing space.

“For the time being, the Treasury market remains decidedly in consolidation mode, and we struggle to envision a breakout in either direction,” they wrote. “Moreover, with 10-year yields now 20 bp (basis points) below the recent peaks, U.S. rates are in a good position to respond to the Trump headlines without doing any technical damage.”