The bull market faces a Trump ‘reality check’ next week, says this strategist. Here’s the trade to make.

It’s a very strong start for stocks on Friday. Perhaps some caution might creep in as the session progresses as traders eye the extended weekend.

Markets will be closed on Monday for the Martin Luther King Jr. holiday, the same day President-elect Donald Trump is inaugurated for a second time.

However, the political theater in Washington could mark a problem for equities, according to Daniel Von Ahlen, senior macro strategist at GlobalData TS Lombard.

“Stocks would likely come under pressure should [Trump] announce more draconic tariff measures than currently discounted or push back against the idea of a more gradual roll-out of tariffs, which his economic adviser team has recently suggested,” says Von Ahlen.

The reason the stock market is so vulnerable to such a scenario, says Von Ahlen, is that valuations currently imply investor optimism.

He notes that one of the main reasons the S&P 500 has gained almost 60% since January 2023 was that Wall Street held relatively bearish expectations for U.S. economic and earnings per share growth.

“U.S. recession call[s] dominated in both 2023 and 2024, which meant the bar for beating those expectations was relatively low. Indeed, in January 2023 the consensus forecast for U.S. growth stood at just 0.3%, while growth turned out to be 2.5%, fueling a massive surge in stock prices,” Von Ahlen says in a note published this week.

Similarly, the current estimate for the final reading of U.S. growth in 2024 is more than twice what was expected at the beginning of that year.

However, at 2.1%, the current consensus estimate for U.S. GDP growth in 2025 is notably more optimistic than that seen over the last two years. This “suggests greater vulnerability for stocks at a time when global policy uncertainty is elevated, and valuations (relative to bonds) have become even more expensive,” says Von Ahlen.

In addition, the rise in Treasury yields after the nonfarm-payrolls report of a week ago shows that better-than-expected growth will deliver tighter financial conditions, which will weigh on stocks.

“Stocks have continued to struggle [this year], suggesting that overall tighter financial conditions (+100 basis points on U.S. 30-year yields, +9% on the DXY [dollar index] since mid-September) are increasingly causing problems for equities, as higher yields on safer assets become available,” says Von Ahlen.

He notes that the last time 10-year Treasury yields hit 5% — in October 2023 — the S&P 500 entered correction territory. “Stocks will be skating on thinner ice if the market adopts our long-held view of no Fed cuts this year,” he says.

To take into account the risk of an imminent Trump tariff shock hitting such a vulnerable market, Von Ahlen suggests the following trade: going long U.S. high-yield credit in the form of the iShares iBoxx $ High Yield Corporate Bond exchange traded fund HYG, and going short stocks, using the SPDR S&P 500 ETF Trust SPY, “as stocks would likely underperform credit in this scenario.”

However, he suggests a tight stop on the trade (a predetermined level at which a losing position will be closed) “in the event of more conciliatory rhetoric from Trump on the tariff front.”

Markets

U.S. stock-indices SPX DJIA COMP are sharply higher at the opening bell as benchmark Treasury yields BX:TMUBMUSD10Y dip. The dollar index DXY is up, while gold GC00 is trading around $2,707 an ounce.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5937.34 |

0.32% |

1.20% |

0.95% |

24.19% |

|

Nasdaq Composite |

19,338.29 |

-0.72% |

-0.18% |

0.14% |

28.45% |

|

10-year Treasury |

4.606 |

-16.30 |

8.70 |

3.00 |

47.48 |

|

Gold |

2731.1 |

0.50% |

3.43% |

3.48% |

34.42% |

|

Oil |

78.25 |

2.19% |

12.46% |

8.88% |

6.56% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

U.S. housing starts in December hit 1.5 million, higher than the forecast 1.33 million. December industrial production rose 0.9% on a month-on-month basis, higher than the 0.3% expected.

The International Monetary Fund published its World Economic Outlook Update , warning that Trump’s policies risk stoking inflation and preventing rate cuts.

SLB’s stock SLB is rising after the oil services company’s earnings beat estimates following a strong showing for its international business.

China’s economic growth hit the government’s target of 5% in 2024 , according to official data.

Shares of J.B. Hunt Transport Services JBHT are dropping more than 10% after the trucking and logistics company reported lower revenue in the fourth quarter.

Nintendo shares JP:7974 NTDOY fell more than in any session in three months after the company was coy about its plans for the Nintendo Switch 2 gaming device .

Germany’s Bundesbank became the latest of the country’s institutions to suspend their accounts on Elon Musk’s X platform .

Best of the web

How corn syrup took over America.

Even Harvard MBAs are struggling to find jobs.

Walgreens replaced fridge doors with smart screens. It’s now a $200 million fiasco.

The chart

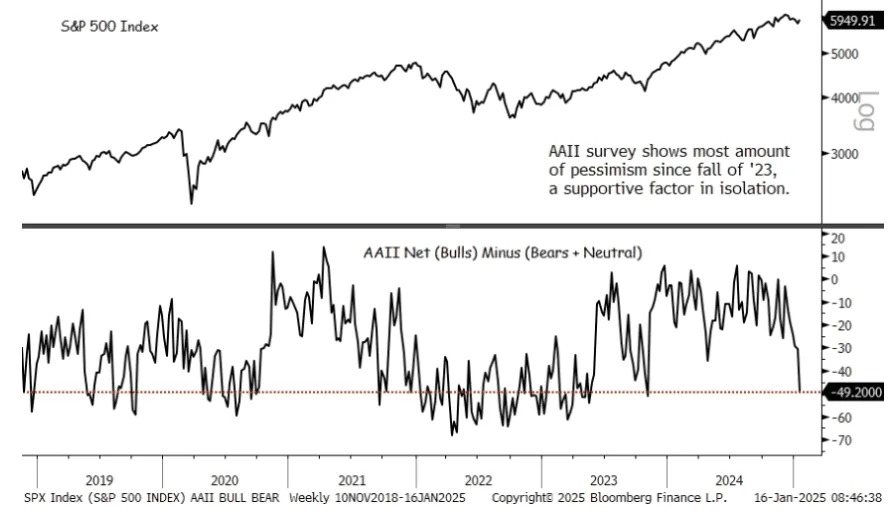

Jonathan Krinsky, technical guru at BTIG, notes that the latest American Association of Individual Investors sentiment survey shows the bulls minus bears spread fell to -49.2, the lowest reading since the fall of 2023. “That is supportive,” he says. It means investor sentiment can readily improve from here. However, Krinsky adds: “Put/call ratios, on the other hand, remain relatively low suggesting investors are perhaps talking bearish, but not acting so.”

Top tickers

Here were the most active stock-market ticker symbols on MarketWatch as of 6 a.m. Eastern time.

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

INFY |

Infosys |

|

MSTR |

MicroStrategy |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AAPL |

Apple |

|

PLTR |

Palantir |

|

RGTI |

Rigetti Computing |

|

PLUG |

Plug Power |

Random reads

Do dogs really watch TV?

Two Swedes played a single point of table tennis for 13 hours.

Worst theme park list has a strong new contender: Pothole Land .

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch , a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple .