Key Beijing official in Hong Kong calls for white paper to elevate capital market

Hong Kong's capital market plays a key role in the city's financial system and national strategies but it falls short in many areas, according to Qi Bin, the deputy at the central government's liaison office in the city.

"Compared with international best practices, Hong Kong still has shortcomings in market regulation, transaction costs and corporate governance," Qi said in a speech at the Hong Kong Capital Markets Forum on Wednesday.

"Hong Kong could explore researching and developing a capital market white paper, proposing improvements benchmarked against the highest global standards."

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge , our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

The white paper could solicit input from all stakeholders, including global institutions to boost investor confidence, benchmarking it against top financial centres like New York and London to elevate Hong Kong's capital market, Qi said.

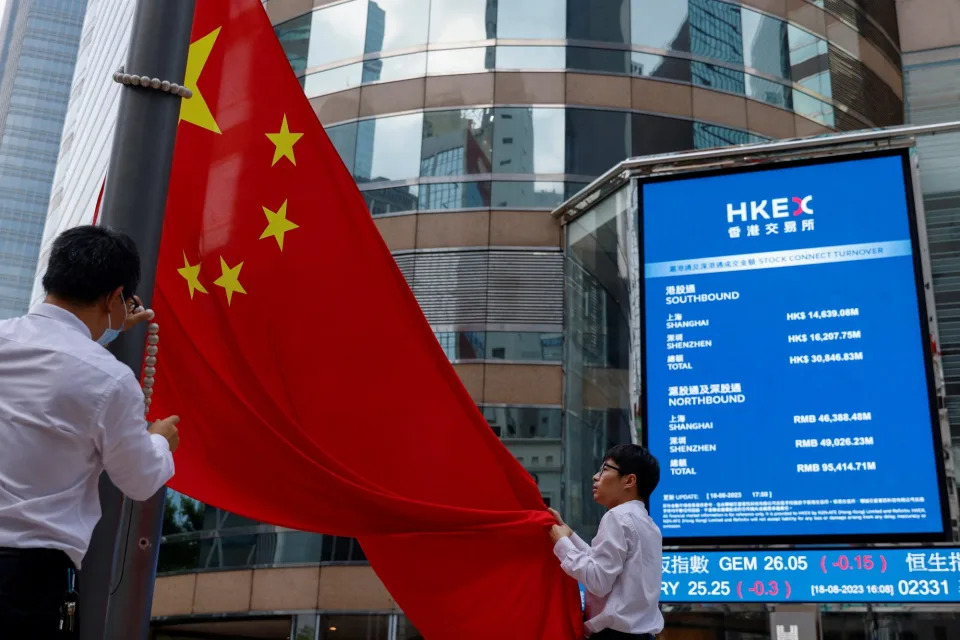

Some 100 companies are in Hong Kong's IPO queue, Finance Secretary Paul Chan told the Capital Markets Forum on Wednesday. Photo: Reuters alt=Some 100 companies are in Hong Kong's IPO queue, Finance Secretary Paul Chan told the Capital Markets Forum on Wednesday. Photo: Reuters>

He highlighted the significance of the city's capital market, which last year performed remarkably well, with the initial public offering (IPO) market regaining its vitality.

"Revitalising Hong Kong's economy hinges on finance, and strengthening Hong Kong's financial sector hinges on the capital market," Qi said, emphasising its strategic role in areas such as supporting the development of artificial intelligence and advancing the Greater Bay Area's growth.

Qi, 57, who studied abroad and has extensive experience ranging from Wall Street firms to China's securities regulator, is considered by many as one of the "brightest financial minds" in the industry. Before assuming his role at the liaison office last November, he spent eight years at China Investment Corporation, the sovereign wealth fund with more than US$1.3 trillion worth of assets under management.

On Monday, Pan Gongsheng, governor of the People's Bank of China, in a speech to the Asia Financial Forum in Hong Kong, emphasised Beijing's commitment to supporting the city's growth as a top global hub.

"The prosperity and development of the capital market are at the core and foundation of Hong Kong's status as an international financial centre," Pan said.

In 2024, Hong Kong's IPO market ended a three-year slump, raising more than HK$83 billion (US$10.6 billion) from at least 66 listings and returning as one of the world's top four IPO venues.

"There are another 100 companies in Hong Kong's IPO queue today," Finance Secretary Paul Chan Mo-po told the Capital Markets Forum. "With more quality issuers and staunch support of the central authorities, we are confident that the liquidity of our stock market will be enhanced."

"Chinese enterprises looking to go public may shift their attention to Hong Kong, which continues to offer strong connectivity to the A-share market through the Stock Connect programme and provide valuable access to global investors through its position as an international financial centre," said Irene Chu, partner and head of new economy and life sciences at KPMG China in Hong Kong.

Hong Kong's financial market is showing positive signs, but there is room to improve on many aspects, Qi said. "But the foundation for continuous improvement remains fragile, the basis for market development is still unstable, and investor confidence needs further strengthening."

To build the city into an international financial centre, "we need to promote more high-quality mainland and international enterprises to list in Hong Kong and optimise the financial regulatory coordination mechanism between the mainland and Hong Kong," Qi said.

"We need to strengthen capital market regulation to prevent financial risks," he said. "We [also] need to advance the development of a Hong Kong capital market white paper to elevate the level of Hong Kong's capital market and build a world-class market."

He said steps must also be taken to host a global industry cooperation summit to establish the city as a hub for global collaboration.

"The proposal to have a white paper can foster more in-depth exchanges between the authorities and stakeholders within the value chain to map out the strategies for Hong Kong's capital markets - not just stocks, but bonds, funds, derivatives and commodities," said Sally Wong, CEO of Hong Kong Investment Funds Association.

This article originally appeared in the South China Morning Post (SCMP) , the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP's Facebook and Twitter pages. Copyright © 2025 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2025. South China Morning Post Publishers Ltd. All rights reserved.