Large-cap U.S. stocks may be heading for a lost decade, this contrarian warns. What to buy instead.

Most discussion of whether there’s a market bubble is entered around the technology sector. But investors may want to look further afield.

So says chief executive Stephen Jon Kaplan, who in our call of the day , warns those bigger U.S. companies may not be worth buying for a decade.

Kaplan says the “real sign of the bubble is that there are many ordinary companies that have price-earnings and price-to-sales ratios which are several times their average historic levels.”

While Apple and Nvidia have made revolutionary tech inventions, “companies like Costco, Visa, Mastercard or Walmart are very unlikely to have similar innovations,” the contrarian-minded investor told MarketWatch in emailed comments.

Costco COST, he notes, has grown profits 8% to 9% per year since 1983, but instead of its typical price/earnings ratio of 8 to 12 times, that gauge topped 60 times briefly in December and currently hovers around 55. Some Wall Street analysts have also flagged Costco’s valuation .

“This is a true sign of a dangerous large-cap U.S. stock bubble, since even if we get a swarm of intergalactic visitors who shop at Costco, its annualized profit growth will not come close to justifying its current price,” said Kaplan.

Costco stock saw turbulence two decades ago, when its stock lost 57%-plus from its 2000 top of $60.50 per share, to the 2002 bottom of $25.94, which gets overlooked given companies like Yahoo and Amazon lost far more in that bubble. He adds that during a Nifty Fifty selloff from 1973 to 1974, “boring” companies like McDonald’s and Coca-Cola slid alongside IBM.

Kaplan fretted about the possibility of a tech bubble last year — which didn’t materialize — but has made prescient calls, such as advice to buy stocks during the 2020 pandemic selloff and a couple of timely warnings on tech selloffs .

He says even if large-cap stocks bottom in 2027 or 2028, and a rebound ensues, he still won’t be tempted in, based stock-market bubble history.

“In 1837, 1873, 1929, 1973, 1999, and again in 2024, U.S. stocks reached extremely high valuations relative to their profit growth. Each time this was followed by a loss of more than 80% on average for the most popular large-cap U.S. shares,” he said.

And each time, the bottoms followed those peaks, and “the big U.S. stocks underperformed most other assets during the next multiyear bull market.” He notes the QQQ QQQ — the ETF that tracks the Nasdaq-100 — fell 83.6% from its intraday top seen March 2000, back to its intraday bottom seen on Oct. 10, 2002.

From there to Oct. 31, 2007 — the top of that cycle — the QQQ was still worth less than of its March 10, 2000 top, he says.

He says investors stand to gain more by putting money in assets that have gone out of favor in recent years.

He said his mid-2025 shopping plans include gold and silver mining shares via ETFs such as VanEck Gold Miners ETF GDX and VanEck Junior Gold Miners ETF GDXJ, Brazilian stocks via iShares MSCI Brazil ETF EWZ and iShares MSCI Brazil Small-Cap ETF EWZS, non-internet Chinese stocks ASHR, and small quantities of other emerging-market stocks through ETFs for Indonesia EIDO, Mexico EWW and Vietnam VNM. The timing of those purchases, he said, may depend on when investors have “given up on all of the above.”

Opinion: The stock market’s ‘Trump bump’ will be back. Just be patient.

The markets

U.S. stocks DJIA SPX COMP opened higher are popping higher after subdued producer prices data , with Treasury yields BX:TMUBMUSD10Y BX:TMUBMUSD02Y and the dollar DXY easing.

|

Key asset performance |

Last |

5d |

1m |

YTD |

1y |

|

S&P 500 |

5836.22 |

-2.33% |

-3.92% |

-0.77% |

22.00% |

|

Nasdaq Composite |

19,088.10 |

-3.91% |

-5.38% |

-1.15% |

27.49% |

|

10-year Treasury |

4.765 |

7.80 |

36.00 |

18.90 |

69.83 |

|

Gold |

2683.6 |

1.39% |

0.50% |

1.68% |

30.68% |

|

Oil |

78.44 |

6.82% |

11.04% |

9.14% |

7.81% |

|

Data: MarketWatch. Treasury yields change expressed in basis points |

|||||

For more market updates plus actionable trade ideas for stocks, options and crypto, .

The buzz

The first of this week’s two big inflation reports — producer prices — showed wholesale prices rising 0.2%, less than the 0.4% rise that was expected. Next up, Wednesday’s all-important consumer prices .

Kansas City Fed Pres. Jeffrey Schmid will speak at 10 a.m., with remarks by New York Fed Pres. John Williams at 3:05 p.m.

The incoming administration of President-elect Donald Trump is considering a slow tariff ramp-up to ease negotiations and avoid inflation spikes, Bloomberg reports .

Ahead of Sunday’s possible U.S. ban on TikTok, the Chinese government may be considering a sale to Elon Musk, Bloomberg reports .

KB Home shares KBH rose after forecast-beating results at the Los Angeles home builder, which doesn’t expect a quick rebuild after the wildfires.

Best of the web

Opinion: Which total market fund is best for long-term investors?

With a TikTok ban looming, users flee to Chinese app ‘Red Note.’

The 3 biggest scams to watch out for following California’s devastating wildfires .

Israel and Hamas may be nearing agreement on a cease-fire deal .

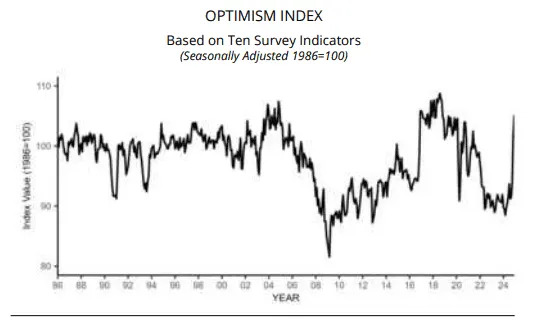

The chart

The National Federation of Independent Business small-business optimism index in December rose to the highest level since Oct. 2018. The index gains were driven by improvements in the percentage of those expecting the economy to improve and the percentage who expect sales to increase.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

|

Ticker |

Security name |

|

TSLA |

Tesla |

|

NVDA |

Nvidia |

|

GME |

GameStop |

|

PLTR |

Palantir Technologies |

|

MSTR |

MicroStrategy |

|

TSM |

Taiwan Semiconductor Manufacturing |

|

AAPL |

Apple |

|

AMD |

Advanced Micro Devices |

|

RGTI |

Rigetti Computing |

|

QBTS |

D-Wave Quantum |

Random reads

Missing after Palisades fire, Oreo the dog reunites with owner.

Just your average coyote, grabbing a few things at the store.

Need to Know starts early and is updated until the opening bell, but to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.