Could the prospective merger of Honda and Nissan transform their futures?

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

Honda and Nissan have signed a memorandum of understanding (MoU) to start discussions that could pave the way for a merger of the two companies. Mitsubishi Motors is also considering joining a new consolidation, which, if it went ahead, would make it the world’s third largest vehicle manufacturer.

In an industry facing great change, whether that be the transition to electrification, or the increasing threat to the traditionally dominant global OEMs by the rapidly ascending Chinese companies, there is something to be said for a safety-in-numbers approach potentially taken by the Japanese companies.

At this stage, we do not view this news of discussions, or indeed any future merger, as truly transformative to the outlook of Honda or Nissan, though there will be some clear benefits.

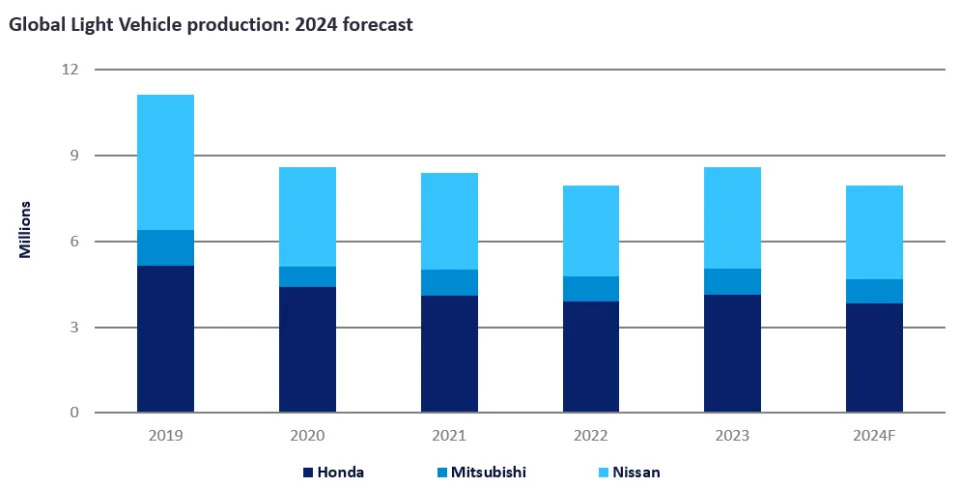

A newly formed Honda-Nissan-Mitsubishi group would have a circa 8 million global Light Vehicle production footprint, based on 2024 projections, which they would look to use to gain scale advantages through vehicle platform sharing and reducing costs. Other savings could be found through sharing other functions, including research and development, by optimizing manufacturing processes, facilities, systems and back-office operations.

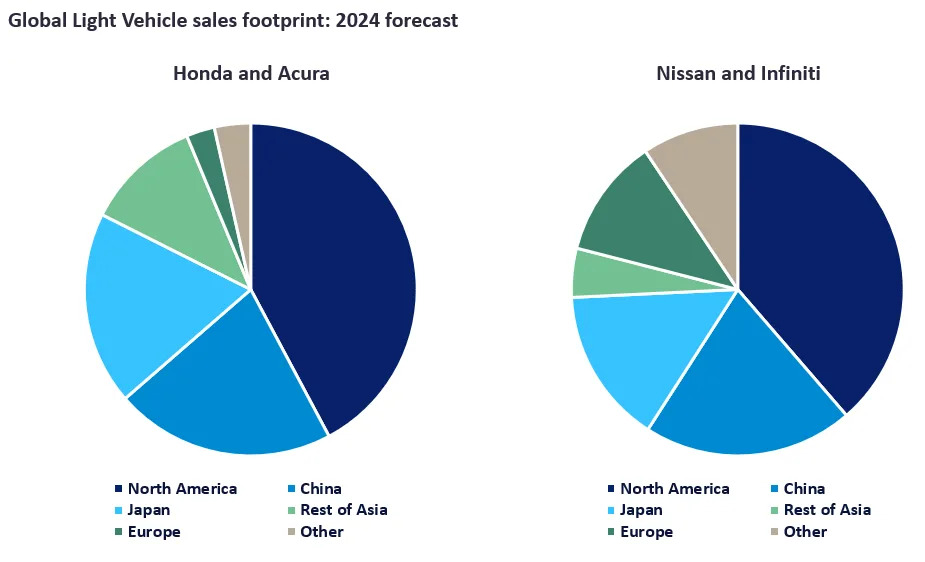

However, while the group’s sheer scale has key benefits, the similarities of the companies limit some benefits one might associate with a tie up of this size. Both have similar sales footprints in North America, a relative lack of presence in Europe, and something of a focus on the Japanese market. Meanwhile, neither are particularly strong in the higher-margin Premium segment, with both Acura and Infiniti claiming modest volumes in recent years. Their individual strengths lie in the Non-Premium segment of the market, one that has only become increasingly competitive with the ramp up of the Chinese OEMs, and the Japanese companies are undoubtably often vying for the same customers.

On the electrification front, the potential merger of Honda, Nissan, and Mitsubishi could enhance their powertrain and Electric Vehicle (EV) capabilities. Nissan's pioneering experience with the Leaf and the more recent Sakura provides expertise in Battery Electric Vehicle (BEV) technology, charging systems, and infrastructure. Honda contributes its proficiency in Full Hybrid Electric Vehicles (FHEVs) and Fuel Cell Electric Vehicles (FCEVs), along with ongoing developments in solid-state batteries, while Mitsubishi adds its expertise in Plug-in Hybrid Electric Vehicles (PHEVs), off-road technologies, and pickup trucks. By combining these resources, the development and production of next-generation EV technologies could be considerably accelerated.

The high costs associated with EV development make resource pooling essential, allowing for scale advantages in research and development, component sourcing, battery resource acquisition, and EV production. This collaboration could lead to more competitive pricing, crucial for competing against Chinese EV manufacturers and challenging established leaders like Tesla and BYD. EV platform sharing could further reduce development costs, expedite time-to-market, and broaden product offerings.

However, despite these potential synergies, there are challenges ahead. Mitsubishi's aging PHEV technology requires upgrades. The distinct hybrid systems used by Honda (e:HEV, a series-parallel hybrid) and Nissan

(e-Power, a series hybrid) necessitate a decision on a unified system to minimize development costs for future hybrid technology. Furthermore, the merger could complicate the companies’ ICE business. Nissan's engine-sharing arrangement with Renault may need re-evaluation, potentially requiring new alternative engine solutions and possibly limiting engine choices in the Internal Combustion Engine (ICE) range for future Nissan products.

Most challenging of all is the competitiveness of Chinese vehicles, especially in BEVs, and their ultra-low prices, which the merger will not resolve. Honda and Nissan have lost nearly half of their production volumes in China in 2024 compared to 2019, while competition from Chinese brands has also intensified elsewhere as they aggressively expand internationally. The U.S. market (and Japan) will be pivotal to Japanese OEMs. The U.S. is one of the few major markets where Chinese OEMs have struggled to enter. Nissan has made the costly mistake of focusing on BEVs and not having HEVs in the U.S. market. It cannot afford any more missteps in that market and could benefit from Honda’s hybrid technologies for future products.

The aim is to reach a definitive merger agreement by June 2025 and complete it in 2026. Through a joint transfer, Honda and Nissan plan to establish a joint holding company that will be the parent entity of both companies. Shares of the newly established joint holding company are planned to be newly listed in Tokyo in August 2026. We will reflect this in our databases accordingly as discussions move forward.

Jonathon Poskitt, Director, Global Sales Forecasts and Asia-Pacific Forecasting Team

See also: Will Honda be in control if Nissan and Honda merge?

"Could the prospective merger of Honda and Nissan transform their futures?" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.