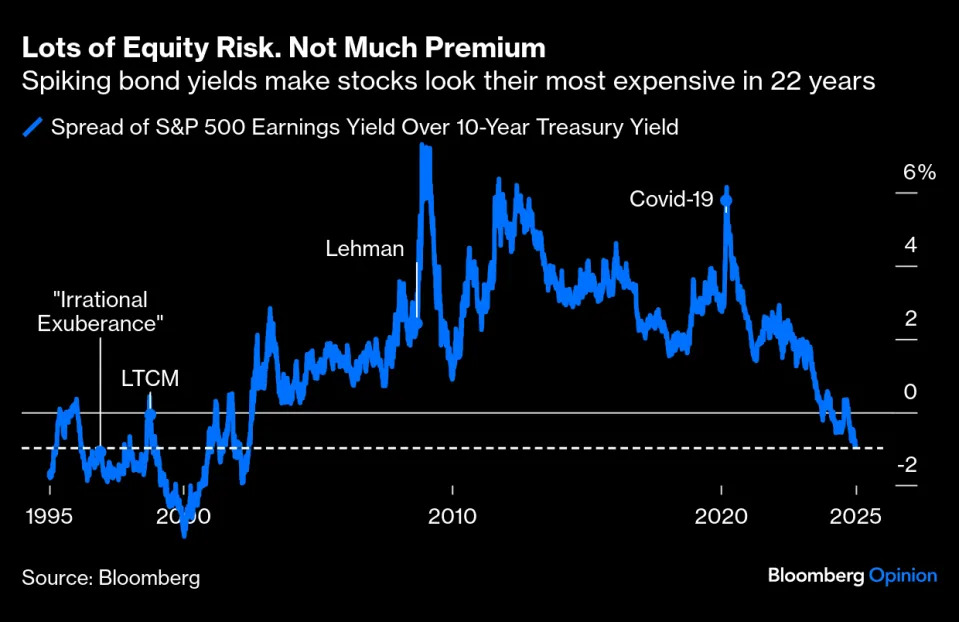

The stock market is at the same valuation as when Greenspan made his ‘irrational exuberance’ comment

U.S. stocks by one valuation measure are at the exact same place they were when former Federal Reserve Chair Alan Greenspan made his infamous “irrational exuberance” comment.

Bloomberg Opinion’s John Authers did the calculation , using Greenspan’s preferred valuation, which compares the earnings yield to the 10-year Treasury.

The earnings yield is just the opposite of the price-to-earnings ratio — it shows how much a company earns per dollar of stock price.

Now it shows that stocks are their most expensive since 2002, but also right at the level when Greenspan made his speech on Dec. 5, 1996 .

The most recent lurch down in Greenspan’s valuation model has less to do with stocks and more to do with surging U.S. bond yields, which are rising on concern about stubborn inflationary pressure ahead of Donald Trump’s second presidency.

The yield on the 10-year Treasury BX:TMUBMUSD10Y rose on Wednesday for the fourth straight day, a period where it rose 12 basis points.

Fed Gov. Lisa Cook on Monday made her own observation on the stock market , saying stock markets (and corporate bonds) are “susceptible to large declines” at today’s prices.

The S&P 500 index SPX managed a small gain on Wednesday and sits just 3% away from its record high.

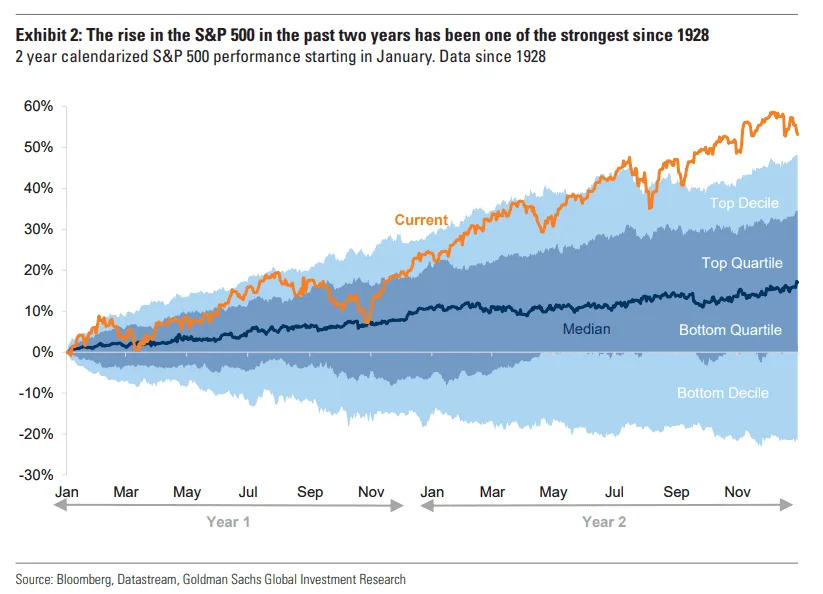

Peter Oppenheimer, chief global equity strategist at Goldman Sachs, said stocks were priced for perfection in a note released Thursday.

“The surge in stock prices in the past two years has been in the 93rd percentile over equivalent periods in the past century,” he said. “While we expect equity markets to make further progress over the year as a whole – largely driven by earnings – they are increasingly vulnerable to a correction driven either by further rises in bond yields and/or disappointments on growth in economic data or earnings.”

The U.S. stock market is shut on Thursday in observance of President Jimmy Carter’s funeral. U.S. stock index futures ES00 NQ00, which will trade until 9:30 a.m. Eastern, were lower after a report on new restrictions coming on Nvidia exports .