2 Promising Stocks to Add to Your 2025 Portfolio

Dell Technologies (DELL)

Similar to how investors underestimated foundry chip stocks in 2023, d ata center companies are being undervalued heading into 2025, with artificial intelligence (AI) now front and center. Dell Technologies is well-positioned for growth, driven by several key factors.

On the technical side, the stock remains up over 50% year-to-date in 2024, with support around the $115 level following its post-earnings spring movement. Any dips toward the round $100 level should be considered as an opportunity, using that level to define risk.

In the options market, put sellers are active at the $100-strike and extending to deep in-the-money $170-strikes for 2025, suggesting strong support for the stock and positioning for stability. Additionally, aggressive out-of-the-money call sweepers have appeared, including a significant sweep of the June 195-strike calls, signaling expectations for substantial upside. The high 50-day buy-to-open put/call volume ratio (96th percentile) indicates that premium buyers may be too pessimistic about the stock, setting up for a potential sentiment reversal.

Dell's Schaeffer's Volatility Index (SVI) of 36%, which is in the 22nd annual percentile, shows that low volatility is currently priced into the stock’s options. However, the company’s consistent ability to reward premium buyers, as evidenced by its Schaeffer’s Volatility Scorecard (SVS) rating of 85, suggests the stock may experience larger-than-expected moves compared to the options market’s low volatility expectations.

Deutsche Bank (DB)

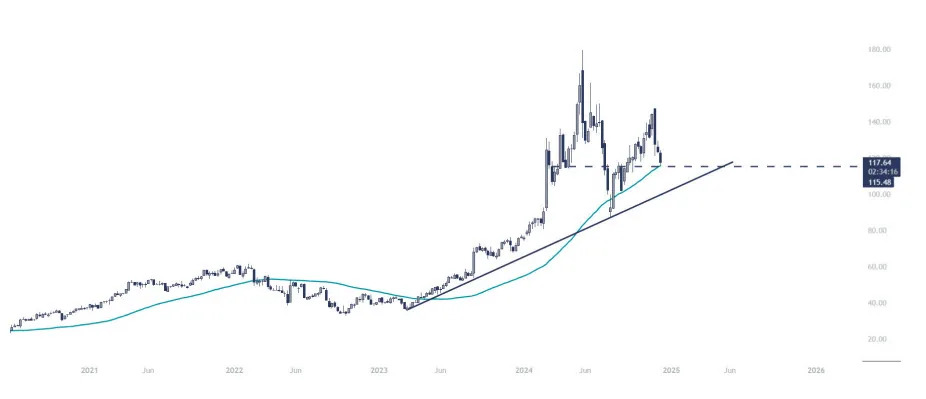

German finance firm Deutsche Bank has been slowly recovering from the financial crisis that hit more than 15 years ago. During the past decade, shares have been very quiet, forming a long-term rounding pattern, suggesting a massive accumulation process. With a breakout above the $15 level in 2024 followed by a couple of retests, we believe next year holds promise for DB.

Another supporting factor is that the 50-week moving average (red line) crossed over a rising 200-week trendline (gold line). Short interest peaked in 2020 and has been moving lower since, but there remains potential buying power, as it would take five days for shorts to fully cover their positions. Despite a 12-month average price target of $20.57, there is still pessimism among analysts, with three "hold" or worse ratings. In other words, Deutsche Bank stock looks ripe for bull notes.

The above excerpts come from Schaeffer’s annual and exclusive Stock Picks for 2025, each one carefully curated by our team of top traders. To continue reading, click here to be one of the first to get their hands on our highly anticipated report of 18 stock picks. Enjoy a head start to a fresh year of trading!