Western European car market flat in 2024 – GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

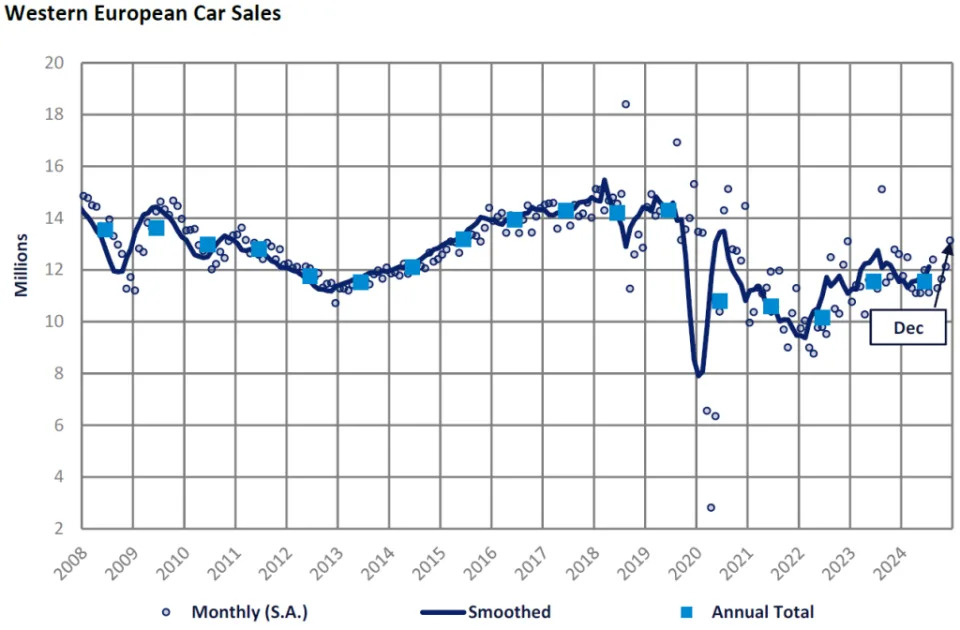

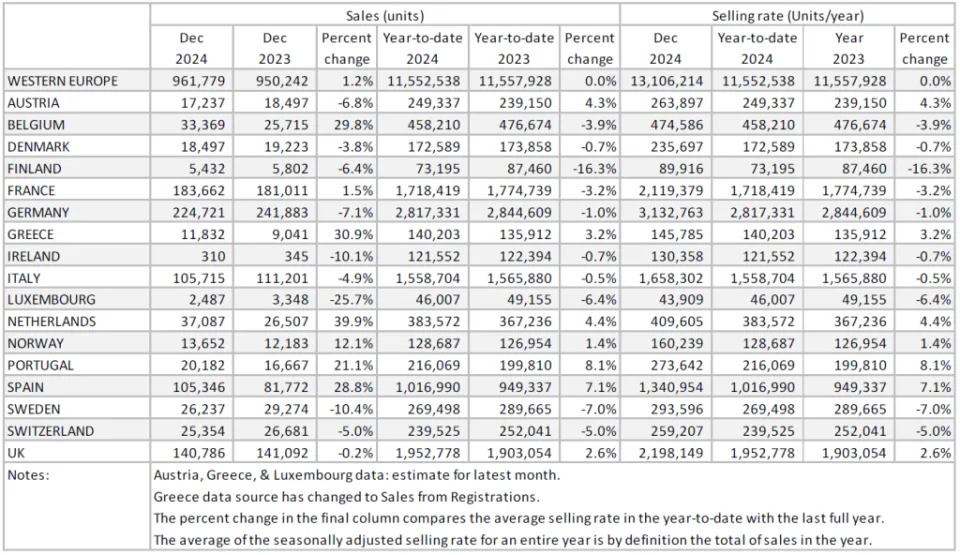

In December 2024, Western Europe’s PV selling rate continued its upward trend, reaching 13.1 million units/year. Year-on-year (YoY), sales volumes increased by 1.2%. However, Italy and Germany experienced declines of 4.9% and 7.1% respectively. The UK saw stable sales, while Spain stood out with a remarkable growth of nearly 29%.

Looking ahead to 2025, the market is expected to receive a boost from rate cuts and the introduction of new models. However, the region is grappling with significant political unrest and economic challenges. Additionally, challenges facing EV sales in key markets like Germany is a cause for concern. While some countries have included subsidies for EVs in their 2025 budgets, the focus on commercial vehicles over passenger vehicles may impact consumer decisions. Poor infrastructure and other factors are also contributing to consumer hesitancy towards purchasing EVs.

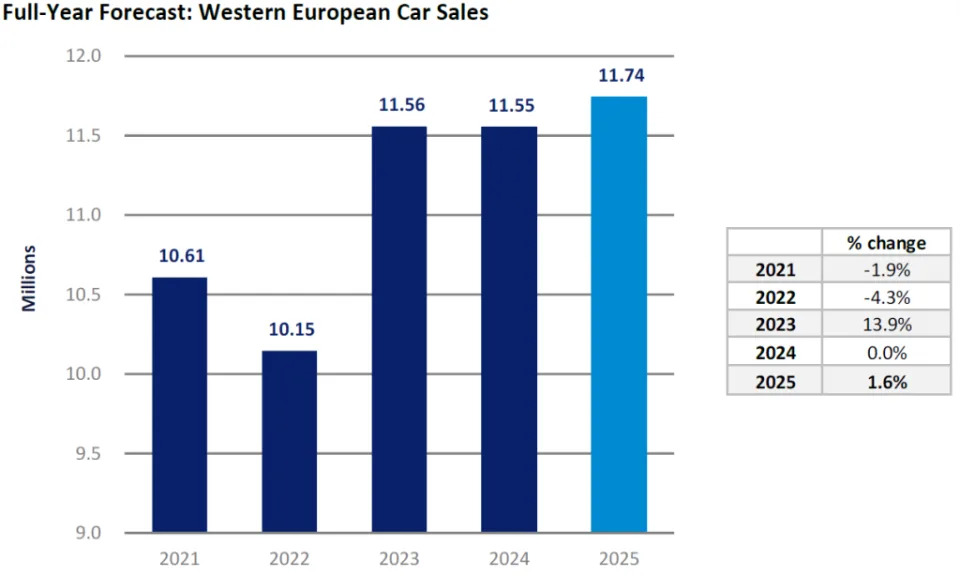

The PV selling rate for Western Europe continued the growth seen in previous months as it increased to 13.1 million units/year. Overall, PV sales remained flat in 2024 with a total of 11.6 million units registered. We expect growth to uptick in 2025 with further interest rate cuts and the release of new, more competitively priced models. Despite this, Europe continues to face numerous political and economic headwinds, especially concerning EV adoption.

The German PV market fell 7.1% YoY in December 2024. However, this compares to a strong year-ago base and the selling rate rose 9.1% MoM to 3.13 million units/year, the best result of the year. EV sales fell by just over 27% in 2024. Tax incentives for company cars should help boost EV sales in 2025; however, pricing and EV infrastructure remain core issues plaguing EV sales. The Italian PV market closed out 2024 with a second successive monthly improvement in the selling rate. However, that failed to translate in positive YoY growth for December, with the latest month instead down 4.9%. This meant that the full-year result for 2024 was down 0.5% on 2023 – for comparison, the 2024 market stands 19% below the 2019 result.

The French PV market increased 1.5% YoY in December. The selling rate also increased by 26% MoM. The growth in car registrations last month can be attributed to a small rebound in the market after seven consecutive months of decline. Despite the overall market trend showing a decrease in sales over the year, the slight increase in registrations last month can be seen as a positive sign. The Spanish PV market finished 2024 with a flourish. The selling rate climbed to 1.3 million units/year in December, comfortably the best result of 2024; it was also the fourth month in a row where the selling rate exceeded 1 million units. In YoY terms, December was up 29%, while the full-year result was a comfortable 7% up on 2023. Sales to individuals and rental companies both performed well according to data for the latest month.

For the final month of 2024, the UK PV market closed the year flat YoY. For the full year of 2024, the UK market stood at 1.95 million units, 2.6% up on the previous year, and therefore the best result of the decade so far. For context though, the market is still 18% lower that the pre-pandemic 2019 result.

"Western European car market flat in 2024 – GlobalData" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.