US light vehicle market ends 2024 on a high as December sales surge – GlobalData

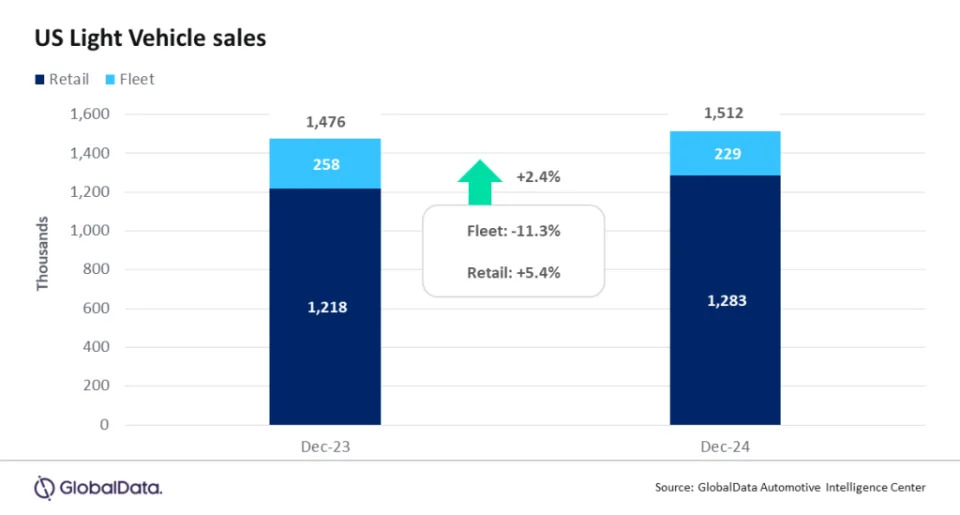

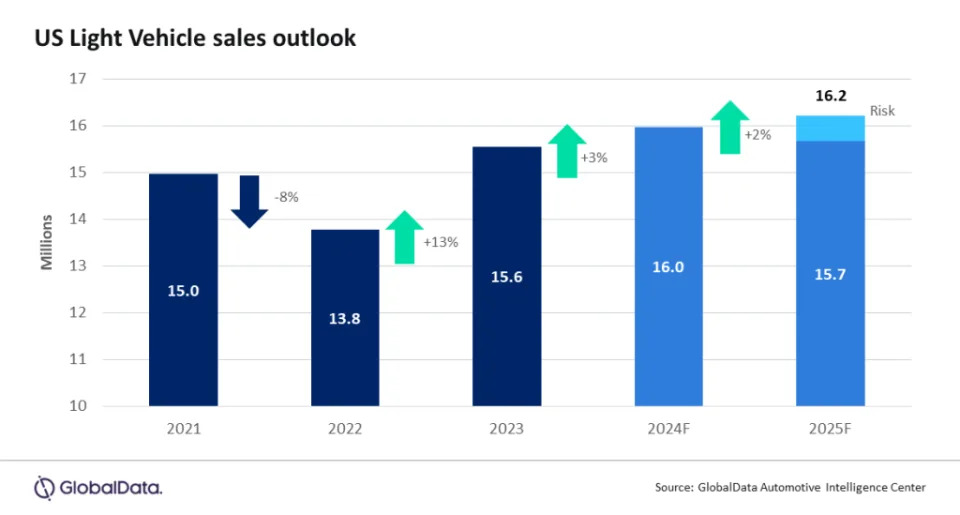

According to preliminary estimates, Light Vehicle (LV) sales grew by 2.4% year-on-year (YoY) in December, to 1.51 million units. Despite the fact that December 2024 contained one fewer selling day than the same month a year earlier, sales showed impressive strength as 2024 came to a close. For 2024 as a whole, sales totaled almost 16.0 million units, growing by 2.7% YoY, making the year comfortably the best for the industry since 2019.

US LV sales totaled 1.51 million units in December, according to GlobalData. The annualized selling rate for the month was 17.1 million units/year, up from 16.7 million units/year in November. This was the strongest rate since April 2021, as some OEMs appeared to reap the rewards of end-of-year sales events, along with relatively plentiful inventory and improved consumer credit availability. The daily selling rate was estimated at 60.5k units/day in December, up from 53.0k units/day in November. According to initial estimates, retail sales totaled 1.28 million units in December, while fleet sales were thought to reach 229k units, accounting for 15.1% of total volumes.

General Motors (GM) had an outstanding month and comfortably topped the sales rankings in December, on 273k units, which is its highest volume in exactly four years. The gap to second-placed Toyota Group was 63k units, the largest difference between the two OEMs since December 2019. Toyota Group’s performance disappointed compared to our expectations, with market share declining month-on-month on a range of its models. One possible explanation is that Toyota did not offer as significant discounts as other OEMs, given that it still has the lowest inventory levels in the industry. Ford Group came in third, on 185k units. For the year as a whole, GM achieved sales of 2.69 million units, for a market share of 16.8%, while Toyota Group reached volumes of 2.33 million units, for a 14.6% share. At a brand level, Ford beat Toyota in December, albeit by a fine margin of just over 200 units. Still, this was the first time the Blue Oval brand had topped the rankings since July 2024. Both Ford and Toyota recorded around 173k units. Chevrolet came in third, on 170k units, and was the closest the make has come to Toyota since March 2023.

The Ford F-150 was December’s bestselling model, on 46.0k units, beating the Toyota RAV4 (44.3k units). Although the F-150 reclaimed top spot in the rankings – a position it had lost to the RAV4 in both October and November – the RAV4 was the victor when the whole calendar year is considered. Across the entirety of 2024, the RAV4 recorded 475k in sales, ahead of the F-150 on 454k units. This is the first time that the RAV4 has ever been America’s bestselling Light Vehicle in a calendar year, and the first time that the F-150 has not led the market since 2012, although the two models were extremely close in volume in 2022.

The Compact Non-Premium SUV segment was the outstanding performer in 2024, and that trend continued with a market share of 21.1% in December. Midsize Non-Premium SUV recorded a share of 14.9%, while Large Pickup enjoyed its highest volumes (222k units) since December 2020 and its best market share (14.7%) since December 2022. Still, a strong closing month was not enough to boost the Large Pickup segment significantly when looking at the whole of 2024, as the segment’s annual market share (13.6%) was its lowest since 2017. Compact Non-Premium SUV’s annual market share of 21.1% was up by 1.3 pp on 2023’s performance, which itself was a record at the time. Clearly, 2024 was a year in which consumers were seeking out more affordable vehicles.

David Oakley, Manager, Americas Sales Forecasts, GlobalData, said: “Buoyed by end-of-year sales events and increasing incentives, December sales were exceptionally robust, even climbing above year-ago levels, which themselves were considered to be impressive at the time. Some consumers may be deciding to buy vehicles now due to concerns that prices could rise further if additional tariffs are introduced by the Trump administration, or if Electric Vehicle tax credits are removed. With that said, vehicles are still expensive in historical terms, with average transaction prices showing no signs of substantial decline yet. However, leasing is providing one means to ease affordability concerns.”

Given the strong demand in the month, the days' supply is expected to decrease to 45 days for December. Overall US inventory levels are estimated to have reached 2.7 million units, a 10% decrease from November. Pickup Truck inventory had been a concern, but now levels are in a healthier state and in line with the rest of the market. Despite North American production being projected to decline by 1% in 2024 to 15.5 million units, it has been effectively managed to support demand. Efforts may be made to build some inventory of at-risk production in Canada and Mexico ahead of any potential tariffs.

In 2024, the LV market continued its recovery, growing by 3% YoY from 2023, approaching the 16.0 million unit milestone for the first time since 2019, although it still lags behind pre-pandemic levels. Retail sales outperformed fleet sales in 2024, increasing by almost 4%, while fleet sales decreased by 1%, accounting for just 17.8% of total LV demand for the year. Despite lingering tariff and economic risks, the US market is showing momentum as it enters 2025 and remains in a generally healthy state. The forecast for 2025 stands at 16.2 million units, reflecting a growth of nearly 2% from 2024.

Jeff Schuster, Vice President Research and Analysis, Automotive, said: “Currently, the industry appears to be closing in on peak performance, but the challenge in 2025 will be sustaining those levels amid a climate of new and continued uncertainty. The threat of tariffs and subsequent price increases pose the largest risk to the US market. If the market can escape the threat of tariffs and prices continue to moderate, there is upside potential to the forecast.”

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center .

"US light vehicle market ends 2024 on a high as December sales surge – GlobalData" was originally created and published by Just Auto , a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.